Q4 2025 Market Recap and Outlook

Global markets closed 2025 on a constructive note, with most major asset classes delivering positive returns despite ongoing macroeconomic crosscurrents. Easing inflation, renewed monetary policy support, and resilient corporate earnings (themes that have benefited markets for much of 2025) all contributed to a broadly positive quarter. The exceptional momentum from AI investments cooled somewhat in Q4, as some investors began to question the valuations and the durability of this trade, leading to a rotation towards more defensive sectors and international markets.

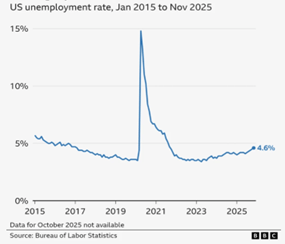

Despite strength in equity markets, economic data once again presented a mixed picture by quarter end. In the U.S., unemployment continued to edge higher, reaching its most elevated level since 2021, while consumer sentiment weakened further, spurred by the longest U.S. government shutdown on record. Against this backdrop, the Federal Reserve opted for a 0.25% rate cut in December, even as tariff related pressures kept inflation readings moderately above expectations. After cutting rates in September, the Bank of Canada cut a further 0.25% early in the quarter (their fourth cut of the year), in response to cooling labour market conditions.

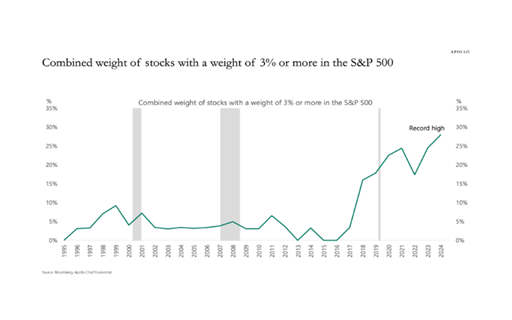

While the final quarter of 2025 was more muted for U.S. markets (S&P 500 Index +2.7% / NASDAQ Composite Index +2.7% / Dow Jones Industrial Average +4.0%), full-year returns were once again very strong, with these indices up 17.9%, 21.1% and 14.9%, respectively. As mentioned above, market leadership rotated in the quarter, with health care (+11.7%) as the leading sector and nine of the eleven sectors positive. Only real estate (-2.9%) and utilities (-1.4%) fell in Q4. For the full year, communication services (+33.6%) and information technology (+24.0%) led the market’s push higher, though all sectors posted positive full-year returns. Despite this, throughout 2025, market performance remained heavily concentrated in just a handful of stocks, with nearly 30% of the S&P 500 Index’s return attributed to just two stocks (NVIDIA and Alphabet), and another 23% attributed to just five further stocks.

Canadian stocks had another strong quarter, with the S&P/TSX Composite Index up +6.3%, ending the year up a staggering +31.7% – its strongest annual return since 2009. As it has for much of the year, the materials sector (+11.9%) led the Q4 charge, with eight of eleven sectors posting positive returns. Similar to the U.S., real estate (-6.2%) was the most signifcant detractor last quarter. For the full year, materials (+100.6%) and financials (+35.3%) were the strongest sectors, though all eleven posted positive gains for the year. Concentration was also a major theme for Canadian markets, with the materials sector accounting for nearly 40% of the S&P/TSX Composite Index’s gain and materials and financials combined accounting for more than 70% of the gain.

International markets continued their positive momentum in Q4, as investors searched for diversity and lower valuations. The MSCI EAFE Index finished the quarter up +3.4% (in CAD), increasing the full-year return to +25.7%, which outpaced U.S. stocks for only the second time in the last 10 years. Both emerging and developed international markets performed well, as the AI boom benefited markets in Asia, and Europe benefited from lower valuations, renewed government spending, and improved prospects of economic growth.

Fixed income markets had a mixed quarter. U.S. fixed income markets gained (S&P 500 U.S. Aggregate Bond Index +1.0%) in response to the December Fed rate cut and expectations that further cuts are ahead, but both the FTSE Canada Bond Universe and Morningstar Global Core Bond Index fell (-0.3% and -1.3%, respectively), as a result of a mix of factors, including less pressure for further rate cuts, a strengthening U.S. dollar and political and fiscal uncertainty. On a full year basis, fixed income returns were modest, with the FTSE Canada Bond Universe up +2.6% and the Morningstar Global Core Bond Index up +2.8%.

Despite an unusually complex backdrop, 2025 produced some exceptionally strong returns. While the gawdy headline index returns need to be viewed with some context (due to a handful of stocks/sectors driving the majority of returns), most investors will remember 2025 as a surprisingly positive year for their portfolios.

OUTLOOK

Every January, investors (and advisors) are bombarded by market forecasts and price predictions for the coming year. Without getting too deep into a rehash of everything we said last year at this time (if you really want to know, just ask and we’ll send it to you!), we caution investors to take these expert predictions with a grain of salt. Most predictions will be for a gain in the range of 7-10% (in line with long-term market averages, which seems reasonable) and yet, almost certainly wrong. How can we say that so confidently? In the last 50 years, the S&P 500 Index has only had a calendar return between 7-10% three times! Extend that out to the last 90 years and it’s still just six times. Last year, the average prediction for the S&P 500 Index was +9.1%...the actual return was +17.9%. Here we are in 2026, and the average prediction is unsurprisingly 9.0% – yet not a single analyst surveyed by Bloomberg has a negative price target on the S&P 500 Index, so take that for what it’s worth. Rather than making our own (and likely very wrong) prediction, we thought we’d focus on a few of the things we are watching and end with a couple of reasons for investor optimism.

We’ve been advising clients, for some time, to be prepared for higher volatility and, except for a few weeks last spring, around the so-called “Liberation Day” tariffs, we’ve largely been wrong. While we weren’t expecting markets to be poor, the steady march high from the April lows through year-end surprised us in its relative calm during a year that felt anything but. The early part of 2026 has been much the same – the capture of Venezuela’s Nicolas Maduro, threats to annex Greenland, renewed tariff threats, all met with relative indifference by markets. While investors can be forgiven for being lulled into complacency, we believe that keeping your guard up in 2026 may become more important. Below are some of the items we are watching that could act as a trigger for the volatility that has largely eluded markets in the last year.

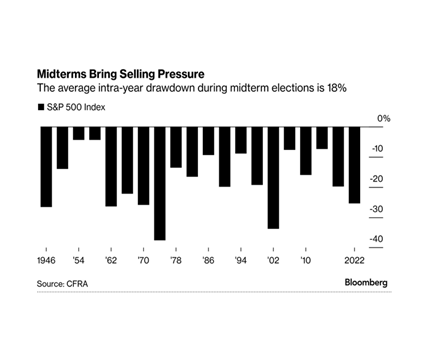

U.S. Midterm Elections

The second year of a presidential cycle is normally the worst, in terms of market performance. Research from Charles Schwab, covering market data from 1933 to 2015, shows that historically, in the second year, the S&P 500 Index’s average return has been just +3.3%, and it is only positive 54.2% of the time (vs. 67% in all one-year periods). Part of this is likely due to uncertainty brought on by midterm elections, which normally bring with them an intra-year drawdown averaging 18%. Markets may be at a higher risk of this in 2026, as affordability issues and President Trump’s plummeting approval rating have led to a haphazard series of actions targeting oil prices, mortgage rates, credit card rates, and Federal Reserve independence. Ed Clissold, Chief U.S. Strategist at the well-respected Ned Davis Research recently wrote that this “industry-specific policy action is a risk heading into midterms.”

Review of the USMCA

While Canadian Prime Minister Mark Carney has been working hard to diversify Canada’s trade relationships and reduce dependence on trade with the U.S. (the destination for 76% of Canada’s exports in 2024), it is difficult to see anything more consequential to Canadian markets in the next six months than the joint review of the United States-Mexico-Canada Agreement (USMCA). The uncertainty over the future of this trade policy (which has sheltered as much as 85% of Canada’s exports from tariffs) is exerting great pressure over the Canadian economy and labour market, according to Canada’s most recent Business Outlook Survey. We expect this to be a contentious renegotiation, and while Canada will be keen to maintain the core provisions of USMCA, it is highly likely the Trump administration may use threats of withdrawal to gain concessions, which could lead to higher tariff rates overall and on specific industries. According to Beutel Goodman, the uncertainty from a long, drawn-out negotiation will “prolong the uncertainty that has already damaged the Canadian economy, resulting in slower business investment, delayed hiring, and precipitate a gradual unwinding of integrated supply chains.”

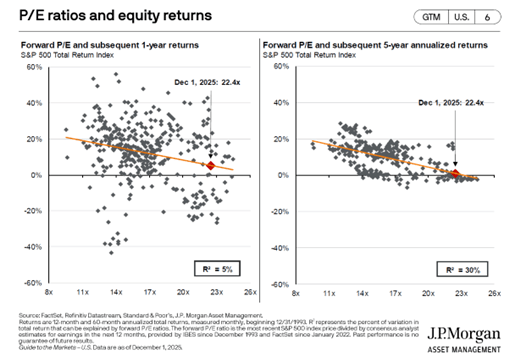

Stock Valuations

Stocks are not cheap, particularly in the U.S. With the forward Price/Earnings ratio for the S&P 500 Index over 22, it is well above its 30-year average of 17.1. This does not mean every stock is overvalued, but it does mean the overall U.S. market is trading at a multiple which is historically unsustainable. Research from J.P. Morgan shows that when Price/Earnings ratios are this high, subsequent one-year returns are typically in the mid-single digits, and subsequent five-year annualized returns are barely above 0%.

While earnings growth has largely justified valuations to this point, the earnings growth of the “Magnificent 7” companies (which comprise a disproportionately large weight in the S&P 500 Index) is expected to decelerate. Accordingly, earnings growth will need to broaden out to the remaining parts of the index, and expectations for that growth may be overly optimistic, especially in the absence of any clear catalysts.

Consumer Sentiment

Rarely has the economy been so bifurcated. High-income households have benefited from rising investment portfolios and the wealth effect, while lower-income households have been disproportionately strained by inflation and the rising cost of essentials like food, rent and electricity (which consume a larger share of their budget). This has led to a collapse in consumer confidence, especially in light of deteriorating employment statistics. The concern here is whether the collapse in confidence will lead to a deterioration in consumer spending (the main driver of GDP). Consumer spending has become increasingly dependent on high-income earners, as lower-income households are already hurting. With sentiment already sour, if the stock market were to decline sharply, wealth effect spending could drop, slowing growth sharply and perhaps leading to a more prolonged decline.

Despite the above sounding rather gloomy, our comments are more focused on the likelihood of increased volatility, rather than a negative view of markets. While we believe caution is warranted, we do see several reasons for investor optimism, namely:

- AI Productivity & Growth – While near-term projections about the significance of AI on profits and productivity may be overly optimistic, even modest realization of AI‑driven productivity gains improves profit margins, supports earnings growth, and helps extend the economic cycle.

- Monetary Policy is Easing – After several years of restrictive policy to combat inflation, rates have normalized and may continue to ease. With both the U.S. Federal Reserve and Bank of Canada cutting rates in 2024/25, rates are no longer a headwind to growth. Lower rates support higher equity valuations and lessen refinancing risk for both households and corporations, leaving more funds for spending and reinvestment. Furthermore, with inflation relatively benign in Canada and hopefully continuing to moderate in the U.S., both central banks should have the ability to cut rates further to support the economy if growth slows or labour markets weaken further.

- Widening Market Breadth – Since mid-October we’ve seen a subtle shift in markets out of the AI and technology mega-cap companies and into the more reasonably priced corners of the markets. This has included more blue-chip value companies, small cap stocks, international equities, and defensive sectors. With markets as concentrated as ever, we think this is a healthy development.

We do not know what 2026 has in store for investors, but we are confident that even if markets struggle at times, investors can do well. Have a plan. Be selective. Be diversified. As always, we are here to answer any of your questions, so please do not hesitate to reach out.

Ryan Cramp, CIM, CFP®

Portfolio Manager

Private Client Group, Raymond James Ltd.

Michael Higgins, BCom, CIM®, FCSI

Associate Portfolio Manager

Private Client Group, Raymond James Ltd.

This Quarterly Market Commentary has been prepared by Ryan Cramp and Michael Higgins and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in the model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Commentary is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund.

Raymond James Ltd. has managed or co-managed a public offering of securities within the last 12 months with respect to Capital Power Corp. and goeasy Ltd.

Raymond James Ltd. has also provided investment banking services within the last 12 months with respect to Capital Power Corp. and goeasy Ltd.