Q3 2025 Market Recap and Outlook

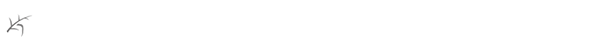

After rebounding sharply from April’s tariff-driven sell-off, global stocks continued their strong momentum throughout the third quarter, as optimism around AI growth, easing trade tensions, solid corporate earnings, and loosening monetary policy pushed most markets to new all-time highs. Of particular note was the steady stream of companies announcing massive investments in AI infrastructure, especially those in the technology sector (see chart to the right), fueling an exceptional rise in that sector.

While stock markets were strong throughout Q3, economic data, which began the quarter seemingly quite healthy, looked more mixed by quarter’s end. With U.S. unemployment rising to its highest level since 2021, and downward revisions to the prior month’s job growth, the Federal Reserve chose to cut interest rates by 0.25% in September, even as tariff pressures pushed inflation readings slightly higher. Somewhat surprisingly, consumer spending has remained resilient, despite sentiment readings continuing to deteriorate. The University of Michigan’s widely followed Survey of Consumers found U.S. consumers’ five-year outlook for their household finances fell to its lowest level in more than a decade. The Bank of Canada also cut rates by 0.25% in September, even though inflation was less of a concern, citing weakening employment.

Despite this mixed economic data, the U.S.’s S&P 500 Index was up +8.1% for the third quarter, while the Dow Jones Industrial Average was up +5.7%, and the tech-heavy NASDAQ Composite Index was up +11.4%. Technology (+13.2%) and communications services (+12.0%) were the leading sectors, accounting for about two-thirds of the S&P 500 Index’s gains. Ten of the 11 sectors in the U.S. were positive last quarter, with the only exception being consumer staples (-2.4%). Dividend and value stocks, while still performing well, lagged the broader index (the Morningstar Dividend Composite Index and Morningstar U.S. Value Index both ended up +6.4% for Q3).

Canadian stocks had an outstanding quarter, with the S&P/TSX Composite Index up +12.5%, more than doubling its return for the year. Soaring gold (+46.6%) and silver (+61.4%) prices have driven the materials sector higher (+37.8%), and despite being only the third largest sector in Canada, it has accounted for nearly 50% of the S&P/TSX Composite Index’s gains for both Q3 and for the calendar year. Like the U.S., 10 of the 11 sectors in Canada were positive last quarter, with only industrials (-1.4%) posting a negative return.

International markets performed reasonably well in Q3 (the MSCI EAFE Index was up +6.9% in CAD), but there was a clear divergence between developed markets (the MSCI Europe Index was up +5.7%) and emerging markets (the MSCI Emerging Markets Index was up +13.1%), with the latter outperforming due to renewed stimulus efforts in China as well as AI-driven gains.

Bonds, which had entered the quarter on a weak note, posted positive returns (FTSE Canada Bond Universe +1.5%; Morningstar Global Core Bond Index +2.5% for Q3), boosted by the U.S. Federal Reserve and Bank of Canada rate cuts. Currencies were relatively subdued, with the CAD down -1.9% vs. the USD, and the USD Index up 0.9%.

OUTLOOK – All in on AI

Massive investment in AI infrastructure has been the primary driver of stock markets in 2025, with UBS forecasting global AI spending to reach $375 billion in 2025. In the first half of this year alone, the AI spending surge contributed to 1.1% U.S. GDP growth, outpacing consumer spending, according to JP Morgan. Investor optimism around AI has sent stocks around the globe soaring. To some, it is the fourth industrial revolution, yet to others, it’s a bubble on the verge of popping. Even some AI industry heavyweights are suggesting caution, with Sam Altman (CEO of Open AI) warning that “people will overinvest and lose money” during this phase of the AI boom. Just how exuberant are things today?

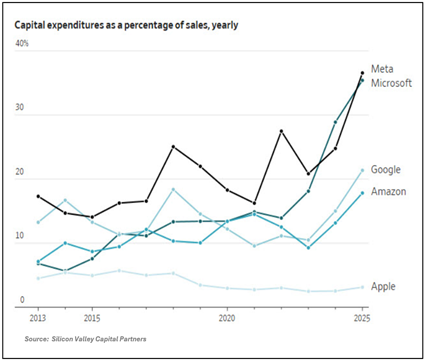

- UBS Group AG tracks a basket of unprofitable tech companies. That basket has gained more than 21% since the end of July, compared with a modest 2.1% advance for its profitable tech counterpart (see chart to the right).

- Industry veteran Michael Cembalest, Chair of Market & Investment Strategy at JP Morgan Asset Management, recently wrote that “AI-related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022.”

Both the International Monetary Fund and the Bank of England have warned of an “abrupt correction risk” tied to the AI investment boom, and with concerns over the concentration and interconnectedness of a handful of major AI companies, skeptics worry that in light of other economic weakness, markets might be vulnerable to a Dot-com-type bubble if these companies fail to deliver meaningful earnings growth. Deutsche Bank recently argued that without AI-related investment, the U.S. economy might already be in recession.

While we are optimistic about the long-term potential of AI to boost productivity and support economic growth, our experience makes us somewhat cautious allocating new money, given the current level of euphoria. That said, there are a number of reasons we are counselling investors to stick to their long-term investment plans:

1) Different than the Dot-com bubble – We can see why many investors liken the current AI boom to the Dot-com bubble of the late 90s. However, the key difference is today’s AI companies generally have solid earnings and cash flows. During the Dot-com era, many companies were relying on debt to fund growth and few had significant cash flow. In contrast, much of today’s AI growth is being funded through companies’ own cash flows and equity investments. Are these stocks overvalued? By most metrics, yes – a late summer report from Vanguard suggested that U.S. stocks would require earnings growth of roughly 40% per year over the next three years to return to “fair value”, but much of the AI boom involves more established companies with positive cash flow, ones that are not likely to disappear the way many Dot-com era stocks did.

2) Monetary policy and history are supportive – As mentioned earlier, despite markets being near all-time highs, much of the economic data over the last three months has shown deteriorating job numbers and falling consumer confidence, giving some investors pause. The one benefit of this is that U.S. and Canadian central banks have resumed monetary policy easing. JP Morgan studied the period from 1980 to 2025 and found just 12 instances where stocks were near all-time highs and rates were cut. In 50% of cases, stocks fellin the first 1-3 months following a rate cut, but in all 12 cases, the market was higher one year later – by at least 15%!

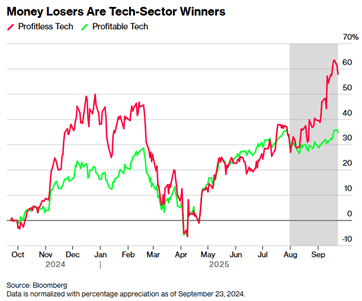

3) Not all stocks are participating – As incredibly strong as the benchmark stock market indices have been over the last few years, not all companies have been participating to the same extent. The S&P 500 Index has become increasingly top-heavy, with the top ten companies (eight of which are tech companies) accounting for ~40% of the index. This concentration has masked the performance of the other 490 companies and skewed perception of market health/performance.

The information from Bespoke Investment Group on the right highlights the S&P 500 Equal Weight Index (a better measure of the average stock performance, as each stock is given an equal weight in the index), which is up just 2.8% over the last 12 months, and shows that there are currently more stocks oversold than overbought. In short, there are likely opportunities for investors outside of the largest companies in the index.

There’s no doubt that the massive investments in AI infrastructure are lending support to parts of the economy, especially the tech sector. That said, it’s difficult to imagine a sustainable future where markets remain so dependent on just a handful of stocks. If history is a guide, such levels of concentration rarely end without some sort of pain. We believe that staying invested and using corrections to opportunistically deploy cash is the right strategy. Diversification and cash flow planning will be safeguards for your portfolio during these times.

As always, we welcome your comments and questions.

Ryan Cramp, CIM, CFP®

Portfolio Manager

Private Client Group, Raymond James Ltd.

Michael Higgins, BCom, CIM®, FCSI

Associate Portfolio Manager

Private Client Group, Raymond James Ltd.

This Quarterly Market Commentary has been prepared by Ryan Cramp and Michael Higgins and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in the model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Commentary is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund.

Raymond James Ltd. has managed or co-managed a public offering of securities within the last 12 months with respect to Capital Power Corp. and goeasy Ltd.

Raymond James Ltd. has also provided investment banking services within the last 12 months with respect to Capital Power Corp. and goeasy Ltd.