Q1 2025 Market Recap

If we had to describe the first quarter of 2025 in one word, upended might be the most appropriate. As we wrote in our previous commentary, the consensus view heading into the year was a soft landing for the economy, a re-acceleration of earnings growth, and a continuation of “U.S. exceptionalism.” Through mid-February, these themes seemed firmly in place. By the end of the quarter, however, the Trump administration’s tariff threats and policy plans had upended that narrative, and investors started to fret over new inflationary pressures, collapsing consumer confidence, and the rising odds of a recession. From the record highs of mid-February, stock markets fell more than 10% in the U.S. and nearly 7% in Canada. Canadian stocks managed to hold on to a modest gain for the quarter, but U.S. stocks were firmly negative, with technology stocks leading the decline.

U.S. markets faced the brunt of the declines in Q1, with the S&P 500 Index down -4.3%, the Dow Jones Industrial Average down -0.9%, and the NASDAQ Composite Index down -10.3%. At a sector level, consumer discretionary (dominated by heavy weightings to Amazon and Tesla) and technology were the worst performing sectors, down -13.8% and -12.7%, respectively. There was a wide dispersion of performance, however, as 7 of the 11 sectors posted positive returns, led by energy (+10.2%) and health care (+6.5%), two of the worst performing sectors in 2024. In a continuation of the “upended” theme, more defensive, value stocks outperformed growth stocks, with the Morningstar U.S. Value Index returning +4.4%, versus a -9.2% loss for the Morningstar U.S. Growth Index. Similarly, dividend stocks outperformed the broader market, as investors prioritized reliable cashflow during the market uncertainty.

As mentioned above, Canadian stocks managed to eke out a small gain for the quarter, with the S&P/TSX Composite Index up +1.5%. Despite tariff threats and the 51st state rhetoric, the gold and silver-focused materials sector (+20.3%) dragged Canadian markets higher, even as only 4 of 11 Canadian sectors posted positive returns for the quarter. While the relatively small health care (-9.0%) and information technology (-7.5%) sectors led the declines, Canadian markets are heavily weighted towards financials (-1.3%), energy (+2.7%), and the aforementioned materials (+20.3%) sectors, which all held up relatively well in the quarter.

International markets, which had largely struggled through the final part of 2024, surged in Q1, amid a rotation away from U.S. stocks. European markets rose +10.6% (MSCI Europe Index) as monetary policy continued to ease, and Germany introduced a massive defence and infrastructure spending plan (a large departure from their decades-long policy of fiscal restraint). Chinese markets were another bright spot in markets, with the MSCI China Index up +15.0%, led by stronger economic growth and optimism over DeepSeek and the country’s artificial intelligence capabilities.

In a quarter where few things felt normal, bonds bucked the trend and resumed their usual role as a portfolio diversifier and ballast in times of volatility. Investors seeking safety in fixed income were rewarded, as bond prices gained on a cloudier economic outlook and in spite of lower expectations for Fed rate cuts. The FTSE Canada Bond Universe gained +2.0%, while the Morningstar Global Core Bond Index rose +2.7%.

Although the quarter was highlighted by volatility and head-spinning news, most investors will likely be happy to see that well-diversified portfolios haven’t fallen nearly as much as dismal headlines might suggest. While it can be tempting to think “this time is different” and be seduced by catchy terms like U.S. exceptionalism, this quarter was a good reminder that tried-and-true portfolio strategies (like being diversified and focusing on dividends) will always have a place in portfolios.

INDIVIDUAL STRATEGY UPDATES

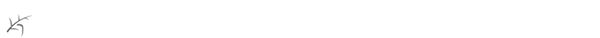

There are currently five investment strategies under our discretionary Private Investment Management Group (PIMG) platform. Four are equity-based and one is comprised solely of fixed income. They are as follows:

- Raymond James Dividend Plus Guided Portfolio

- Raymond James Financial Equity Income Guided Portfolio

- Raymond James Ltd. North American Enhanced Yield Guided Portfolio

- Raymond James U.S. Core Guided Portfolio

- Fixed Income (third-party funds/ETFs)

On the following page, you will find a table outlining some of the key figures for Q1 2025 for each of the above PIMG strategies.

Clients may have exposure to between one and five of these strategies. The asset allocation and weightings of each strategy have been tailored towards each client’s unique investment objectives and risk tolerances. If you would like a reminder of your specific exposure to each of them, please don’t hesitate to reach out to us.

As a reminder, the returns for your individual accounts (as well as your household) can be found on the attached Quarterly Portfolio Review report. The figures on these reports are all in CAD and net of all costs.

OUTLOOK – Tarrif-ied

While the first quarter of the year ended on a lacklustre note, it has really been the events of the first few weeks of April that have been the most unsettling for investors. Volatility has spiked to levels last seen during the COVID crisis, and the daily barrage of ever-changing policy and haphazard tariff announcements have investors exhausted and on edge. It’s during these times that our human nature wants us to do something, anything, to try to control the outcome. The age-old advice of “stay the course” and “focus on the longer-term” is correct, but incredibly difficult to follow at times. However, as Marc Williams, Portfolio Manager at Leith Wheeler, recently wrote, “As money managers (and fellow humans), we are not immune to feeling this impulse to act, but when you have done a good job in advance of understanding risk, assessing quality, and diversifying holdings, the panic-now think-later mantra can be incredibly value destroying.”

How value destroying? Extremely. Bespoke Investment Group recently provided us some research on the four worst times to buy stocks over the last 40 years, which were September 1987 (before the 1987 crash), March 2000 (before the dot-com peak), October 2007 (before the Financial Crisis), and February 2020 (before the COVID crash). What if instead of riding the stocks down, you’d moved your portfolio to bonds before the declines?

According to Bespoke, “Since each of those ill-fated buy points, U.S. stocks have still returned at least 7.7% on an annualized basis and have outperformed bonds over all four spans.” As shown to the left, the stock outperformance is significant … about double or more the bond return in all cases. The takeaway from this is that the stock market is forgiving if you give it time, and the key to giving it time is having a solid investment plan.

So, what has changed?

The tariff levels initially proposed by the White House shocked markets across the globe and were well beyond even the most pessimistic predictions. While much of this has been walked back (at least temporarily), there has already been damage done. Both consumer and business sentiment have fallen to near record lows, neither of which bodes well for economic growth (consumers need confidence to spend and businesses need confidence to hire people and invest in equipment). This has led to the slashing of global growth rate expectations and renewed talk of recession, with J.P. Morgan Research recently raising their probability of a recession occurring in 2025 to 60% – up from 40% previously.

Inflation expectations are increasing. Tariffs make the cost of goods more expensive for consumers (some U.S. businesses are already reporting changes in their customers' behaviour because of the tariff uncertainty). The particularly feared scenario is where growth stagnates, but inflation remains elevated – otherwise known as “stagflation.” In this case, central banks may find themselves boxed in, with little room to cut rates and stimulate the economy without pushing inflation even higher.

Lastly, trust in America and faith in American exceptionalism are fading. The Trump administration wants to reshape the country, bring back manufacturing jobs and reorder global trade and politics to its liking. The problem is the rest of the world isn’t obligated to agree with these policies. While the White House has publicly stated that the U.S. needs to brace for some short-term economic pain for long-term gain, there is a question of just how much pain they will let the economy endure before changing tact.

For example, the U.S. Travel Association said in February that a 10% reduction in tourism from Canada alone could put 140,000 jobs at risk and result in $2.1 billion in lost spending, while more recent data shows a 30% decline in Canadian land travellers and a more than 70% decline in airline bookings. While Canada accounts for more than one quarter of tourism to the U.S., all international travel to the U.S. is cratering and a recent Goldman Sachs estimate pegged the cost from reduced travel and boycotts at $90 billion or 0.3% of GDP. This may apply more pressure than the administration currently thinks.

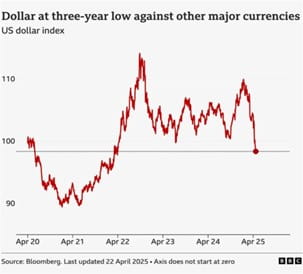

Similarly, recent data has been showing a rotation by global investors out of American assets and U.S. dollars. The U.S. derives tremendous value from being the most predictable and liquid capital market, but erratic policy and attacks on things like the Federal Reserve’s independence is eroding trust. The U.S. dollar has recently fallen to a three-year low against other major currencies and while it won’t lose its status as the world’s reserve currency any time soon, even some Fed officials have suggested that the U.S. can no longer take this for granted.

Investors have taken note of this and embraced a “sell-American” sentiment in recent weeks. Amundi SA (Europe’s largest asset manager) recently noted that investment clients have “massively repositioned” their portfolios. This is corroborated by data from Morningstar Direct that showed in the first two weeks of April, U.S.-focused funds from Amundi, UBS, and State Street saw a combined €3.9 billion in outflows (about $4.5 billion USD).

Even some of Trump’s most high-profile supporters like Ken Griffin (Citadel Capital) are beginning to question the implications of the recent White House actions. “People are not going to race to build manufacturing in America,” Griffin said of the tariffs. “With the policy volatility, you actually undermine the very goal you’re trying to achieve.”

The seemingly endless barrage of announcements and U-turns have unleashed some of the wildest stock swings that we’ve seen in years. We don’t expect we are through it yet, so be prepared for more ups and downs in portfolios. Until tariff wars are settled and new trade deals negotiated, this may be the new normal. What has not changed though, is our advice … focus on quality, focus on income, stay diversified, and have a cash flow plan. This too shall pass.

Please don’t hesitate to reach out if you have any questions or would like to meet with us.

This Quarterly Market Commentary has been prepared by Ryan Cramp and Michael Higgins and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in the model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Commentary is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund.

Raymond James Ltd. has managed or co-managed a public offering of securities within the last 12 months with respect to Capital Power Corp., goeasy Ltd., WSP Global Inc., and Intact Financial Corp.

Raymond James Ltd. has also provided investment banking services within the last 12 months with respect to Capital Power Corp., goeasy Ltd., WSP Global Inc., and Intact Financial Corp.