Q3 2023 Market Recap

Heading into the early part of the 3rd quarter, investors remained largely bullish, still buoyed by fading anxiety over both inflation and recession. As the quarter progressed, that optimism started to wane as realization set in that central banks were unlikely to start pivoting to lower rates as quickly as once thought. The new market catchphrase of “higher for longer” has taken hold and markets that initially benefited from better-than-expected employment numbers, inflation data, and corporate earnings have reversed and are now viewing this positive economic data as rationale for central banks to maintain or even continue increasing interest rates. The result was a decline in nearly all global markets and a jump up in bond yields (leading to a decline in bond prices).

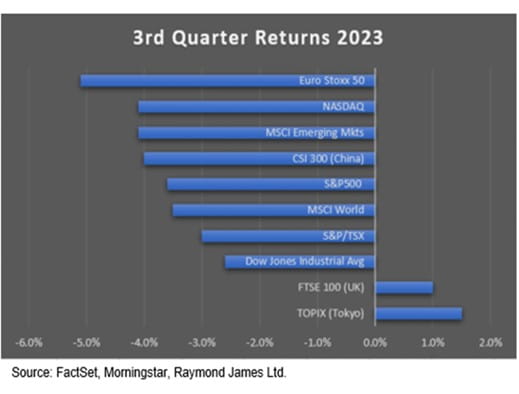

In the U.S., the “Magnificent Seven” stocks which had provided the market with most of its gains in the first half of the year, retreated, leading the NASDAQ Composite Index to a decline of -4.1% in the quarter, while the broader-based S&P 500 Index fell -3.6%. The more value-oriented Dow Jones Industrial Average was down only -2.6%. During the quarter, only two of the eleven S&P 500 Sectors were positive, with Communication Services up 2.8%, and Energy up a whopping 11.3% on the back of supply constraints and the Israel/Palestine conflict.

Canadian stocks slightly outperformed their U.S. counterparts with the S&P/TSX Composite Index down -3.0%, largely due to the index’s higher weighting to oil. The Energy sector was up +8.9% during the quarter and like the U.S., there was only one other sector positive in the quarter (Healthcare +13.8% ... though it is the smallest sector in the index).

Internationally, markets were led by small gains in the U.K. and Japan, but pulled down by a -5.1% decline in European stocks.

While European stocks have performed strongly over the past 12

months (+26.4%), they may face new challenges as the European Central Bank keeps rates higher for longer and Germany, France, Italy and Spain are all edging towards recession. China (down -4.0% in the quarter) continues to see its debt and property woes worsen and remains the worst performing market over the last year.

The “higher for longer” narrative led bond yields to spike to their highest level since 2007, resulting in a terrible quarter across the bond spectrum with only short-term bond indices being spared. The broad-based Morningstar U.S. Core Bond Index lost just over 3% – its biggest quarterly decline since the third quarter of 2022. While yields on bonds are attractive, especially over a multi-year horizon, the price declines this quarter have all but shortterm bond indices flirting with a second straight year of negative returns.

At the quarter’s end, expectations that central bank rate cuts are further down the road and likely to be less significant than expected just a few months ago, have many investors feeling like they are on less-solid ground than at the start of the quarter. However, with positive seasonal trends (the 4th quarter is historically the strongest in markets), low expectations, and valuations/dividend yields in equity markets looking quite attractive, it is important to keep long-term goals in mind and stay diversified.

OUTLOOK – Higher for Longer

Over recent weeks, “higher for longer” has become the new catchphrase on Wall Street. Central bankers, haunted by the mistakes made two years ago, do not plan to underestimate inflationary pressures this time. Even as inflation has shown meaningful signs of slowing, central banks have remained resolute in their plans to bring it down to their 2% target. Investors, who were optimistic of a soft landing just a few months ago, are now coming around to the idea that the longer rates stay higher, the better a chance of recession. As we said in our previous quarterly update, “if monetary policy is tight enough to fix inflation, it’s likely to hurt economic output as well”.

So where does this leave investors as we head into the final months of the year? Well, our base case remains that there is a mild recession in both Canada and the U.S. during 2024. According to the Raymond James Investment Strategy Team, “If the economies slip into recession, we expect that would mean that unemployment ticks up and consumer spending declines, taking down inflation, and enticing central bankers to slowly reduce rates to limit job losses and ensure a mild and short-lived recession, but having still achieved the ultimate goal of bringing down inflation.”

To date though, unemployment has held steady and consumer spending has been stronger than expected, leading us to believe it may be later into 2024 before we see this start to happen. In the shorter term, with positive seasonal trends (Q4 is historically the strongest part of the year for equity returns), recent declines, and compelling valuations (especially in Canada where the market is trading below its 20-year median Price/Earnings multiple), adding quality equity names, especially dividend payers/growers that you’d be comfortable owning longer-term, feels appropriate.

Fixed income markets, especially after the 3rd quarter’s climb in yields, offer compelling opportunities to lock in returns that in many cases may be equity-like. Fixed income investments have been surprisingly volatile over the last 2 years (and prices could yet be impacted if rates continue to rise), but historically, future returns have been largely dictated by the current yield and these are currently among the best we’ve seen in decades.

We recognize the last quarter was an uncomfortable one for many investors. Markets react quickly to both good and bad news (and sometimes to good news interpreted as bad news…or vice versa). Staying invested in the right assets for your long-term objectives and risk tolerance is almost always the most prudent approach. Volatility is uncomfortable but it is exceedingly normal. The chart on last page shows the S&P 500 Index’s calendar returns for the last 35 years, but also shows (in red) the largest top to bottom market decline within that year. On average, there is a decline of nearly 10% during each year, even if markets end the year positive. The takeaway is to stay invested, especially when times feel tough.

As always, if you would like to review your portfolio strategy or have any other questions or concerns, please don’t hesitate to touch base. We are here to help!

Sincerely,