Q1 2023 Market Recap

After a difficult 2022 for both stocks and bonds, the first quarter of 2023 was a welcome sight to investors, and looking at the final numbers, it was a pretty decent quarter with virtually all markets and asset classes posting positive results. The path higher, however, was far from smooth. The early part of the quarter saw a continuation of the late 2022 trends, with investors feeling that inflation was subsiding and that central banks might be able to stop raising interest rates sooner rather than later, and perhaps even cut rates by the end of the year. As the quarter developed though, the picture became less clear. The Bank of Canada paused their interest rate hikes, but admitted getting inflation back down to 2% would be “more difficult”, a sentiment echoed by the U.S. Federal Reserve, who chose to continue raising rates (albeit at a slower rate). Stickier inflation data and shifting expectations that rates may yet move higher and be held there longer, began to weigh on markets as we entered March.

Then came the second part of the quarter where focus shifted dramatically (almost overnight) to the banking sector with the collapse of Silicon Valley Bank and a sell-off in the financial sector and broader markets. While Silicon Valley Bank was no doubt a casualty of higher interest rates (and we could devote pages to discussing this), it appears more of a case of mismanagement than evidence of broader, systemic issues, and bears little resemblance to the 2008 financial crisis. Markets seemed to agree with this assessment and rallied through the final week of the quarter.

As mentioned above, nearly all markets posted positive results for the quarter, but in a reversal of the 2022 trend, the technology-heavy NASDAQ Composite Index led the charge, posting a +16.8% return for Q1 2023, while the broader-based S&P 500 Index rose +7.5%. As might be expected given the NASDAQ’s performance, growth stocks outperformed value stocks for the quarter. The strongest sectors in Q1 were Information Technology (+21.5%) and Communication Services (+20.2%), while recession concerns and the Silicon Valley Bank collapse led Energy (-5.6%) and Financials (-6.0%) to be the two worst performing sectors.

Canadian markets underperformed their U.S. counterparts, but the S&P/TSX Composite Index still managed a +4.6% return in the first quarter. While 10 of 11 sectors were positive for the quarter, a return of -3.6% for Energy and +0.6% for Financials (the two largest sector weights in Canada) explain this underperformance, and again were weighed on by rising recession concerns and contagion concerns from the Silicon Valley Bank collapse.

International markets continued their recent strong performance, with the MSCI EAFE Index up +9.0%, thanks largely to a record monthly drop in Eurozone inflation figures. Emerging Markets were up +4.1% despite some spillover from the volatility in the global financials sector.

For the second quarter in a row, bonds outperformed cash, with the Morningstar Global Core Bond Index up +2.8% in the quarter. With yields falling and credit conditions tightening over the quarter, high quality bonds outperformed their lower quality counterparts. More importantly, however, bonds also re-assumed their role as a portfolio diversifier, providing ballast to portfolios during the recent financial sector volatility.

While the strong performance across all markets is a welcome development for all investors, the remainder of the year remains a challenge to forecast. Recession risk remains elevated and the yield curve continues to be inverted (a relatively consistent precursor to recession), yet the labour market remains strong (solid wage growth and unemployment near record lows) and corporate earnings to date have remained stronger than expected. We anticipate there will be more volatility to come, so have been rebalancing back to neutral weights for those who are underweight fixed income/bonds. With that said, markets will rally long before the economy has bottomed, so maintaining quality equity exposure is important.

OUTLOOK – Mixed Messages

As mentioned earlier, the remainder of the year remains a challenge to forecast. Recession predictions vary wildly, from we’re already in one now, to there won’t be one at all … the so-called soft landing. It is hard to conclude that we are in one now, given the strong employment figures and consumer spending data (remember that consumer spending makes up about 70% of U.S. economic activity). Yet on the other hand, the Leading Economic Indicators Index has contracted to levels consistent with previous recessions, the yield curve remains inverted with short-term rates higher than longerterm rates, and the recent re-steepening of the yield curve (a nearer term indication of recession) are all flashing warning signs.

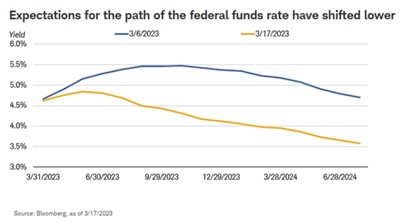

Central banks will continue to be an essential factor in how the rest of the year evolves for markets. While Canada has already paused its rate hiking cycle (though isn’t projecting a cut any time soon), the Federal Reserve continues to raise. As shown in the chart below, markets now expect cuts to the federal funds rate in the second half of the year. This likely indicates a higher risk of recession. However, historically speaking at least, the Fed stopping its rate hiking cycle (the Fed Pivot) has generally been a great environment for stocks with the average 12-month return after the pivot being 19%.

Back to our mixed messages though, the Fed has repeatedly said that cutting rates in 2023 isn’t their baseline expectation, so this divergence between what the market expects and what the Fed is saying, could be a source of volatility in coming months

As mentioned in our last update, the Fed is laser focused on making sure they slay the inflation dragon, and have repeatedly referenced policy mistakes of the 1970’s as a reason to keep interest rates higher for longer. While an economic slowdown and slowing inflation may give the Fed some reason to slow or pause its rate hiking cycle, it’s the failure of Silicon Valley Bank that may be driving some of the rate cut expectations.

The secondary effects of the bank failures are just beginning to impact the economy and it’s expected that lending standards will tighten (banks less willing to lend). This will create a headwind for economic growth and may actually help the Fed address its most significant concern: inflation. If this leads the Fed to a quicker pause or rate cut, it could provide a tailwind to stocks.

Our view remains that there is likely a mild recession over the next 12-18 months, but that strong household and corporate finances are likely to limit the depth and duration. This does, however, bring with it the risk of sudden bouts of volatility. We recommend being patient and staying diversified. This is not a time to take undue risk, but also not a time to abandon your long-term strategy. While bonds and cash look attractive in the near term (and certainly have a role to play in portfolios), the tendency is to want to overweight these things during uncertain times and “wait out” the volatility. We remind investors that the best and worst days in the market tend to be clumped together, and attempting to time the market can negatively impact your long-term returns.

If you would like to review your portfolio strategy or have any other questions or concerns, please don’t hesitate to touch base. We are here to help!

Sincerely,