Q2 2023 Market Recap

With the first half of 2023 now in the books, we find ourselves still searching for many of the same answers we were earlier this year. There remains plenty of data for both bullish and bearish investors to support their respective theses, and while stock market indices largely pushed higher during the quarter (especially in the U.S.), it was a very narrow subset of companies that led them there.

Investors went into the second quarter on high alert for a recession and with the expectation that central banks could soon be cutting rates. Instead, with core inflation remaining sticky, the U.S. Federal Reserve raised rates again in May and even though they paused in June, are still guiding that more increases should be expected. Here at home, the Bank of Canada also resumed raising rates after pausing earlier this year, citing inflationary pressures due to “robust demand and tight labour markets”. These changing expectations sent rate-sensitive bonds slightly lower in the quarter.

In the U.S., there were significant divergences in regards to stock index performance during Q2. The technology-heavy NASDAQ Composite Index gained 12.8% in the quarter, while the broader-based S&P 500 Index rose 8.7%, and the technology-light Dow Jones Industrial Average was only up 3.4%.

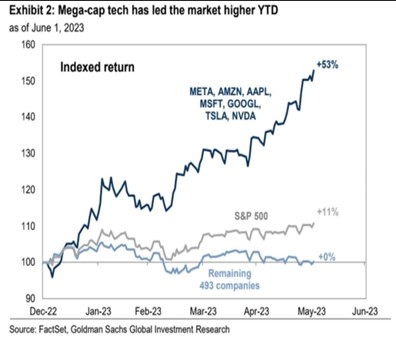

As you can see in the chart to the left, it is the “Magnificent Seven” (Meta Platforms, Amazon.com, Apple, Microsoft, Alphabet, Tesla, and Nvidia), that have provided nearly all of the S&P 500 Index’s year-to-date return, while the remaining 493 stocks have averaged close to 0% (figures as of June 1st). Not surprisingly, Information Technology was the strongest performing sector last quarter (+16.9%), while six of the S&P 500’s 11 sectors were either down (Consumer Staples, Energy, and Utilities), or up less than 3% (Healthcare, Materials, and Real Estate). Growth stocks outperformed value stocks for the second consecutive quarter.

Canadian stocks were relatively flat in the quarter, as the S&P/TSX Composite Index gained just 0.3%. With seven of the index’s 11 sectors down for Q2 and our largest sector (Financials) up a modest 0.9%, there wasn’t much market performance to celebrate on Canada Day.

International stocks fared slightly better than Canadian ones in Q2, with the MSCI EAFE was up 1.4%. This was led by strength in Japanese stocks (the NIKKEI 225 Index was up 18.4%); however, slower than expected economic growth in China led to weakness in both Shanghai’s CSI 300 Index (down 5.1%) and Hong Kong’s Hang Seng Index (down 7.3%).

It was a mixed quarter for bond investors as they came to terms with the idea that rates aren’t coming down any time soon. Shorter term investments like high interest savings funds and T-Bills were positive due to higher yields, but broad indexes like the Morningstar Global Core Bond Index (-3.83% CAD for Q2) fell as rates went up.

At the quarter’s end, with no economic downturn imminent, and many measures of real economic activity remaining resilient, there has been renewed optimism and chatter of a soft landing (central banks positioning monetary policy to be tight enough to bring inflation back down to target, but not so tight that we have a recession). Yet with recession warning signs still flashing and central banks still warning of interest rate increases to come, it’s unclear whether the coast is really clear. More than ever, it is important to stick to your investment strategy and remain diversified.

OUTLOOK – Still Searching

As mentioned earlier, the answers to many of the same questions we were asking ourselves earlier this year remain unanswered. When will a recession come? Can central banks thread the needle and engineer a soft landing? When will interest rates stop rising? When will they fall?

A lot of recent headlines have suggested that we are in a new bull market, given that the S&P 500 Index has gained 20% since its October 2022 low. Considering this rally has largely been driven by a small number of stocks, we are cautious of this assumption and would not be surprised to see increased market volatility over the back half of this year. Markets do not move in a straight line and as one of our senior colleagues pointed out, since 1950, the average ‘dip’ in the S&P 500 Index between now and December is -9%. While we certainly hope the markets continue to rise, we are also prepared for this possibility of volatility.

We also remain in the camp that North American recessions are likely in the next 12-18 months. Our basic premise being that if monetary policy is tight enough to fix inflation, it’s likely to hurt economic output as well. Currently, the consensus (as surveyed by Reuters in June) has a recession in the U.S. starting in the final quarter of 2023, though this creeping slowdown has continually been pushed further and further out and may not occur until 2024. The positive to this is that a later recession is likely a milder recession for the simple reason that inflation will have likely fallen enough for central banks to cut rates more aggressively in response.

Does this mean we are changing our approach to markets? In a word, no. Have no doubt, we are long term believers in equity and it is a critically important part of portfolios. There is an old adage that “a bull market climbs a wall of worry” and while there is plenty to worry about, there is also much to be optimistic about. As Neil Linsdell, Raymond James Head of Investment Strategy commented in a recent report “We are optimistic about longer-term growth opportunities that might be spurred on by factors like the U.S. Inflation Reduction Act, Artificial Intelligence (AI), or an industrial resurgence in North America, as governments look to build manufacturing capacity to protect against future supply chain issues like the ones we experienced through the pandemic”. While the Magnificent Seven have driven index returns in 2023, they are also the reason the market looks expensive. Savita Subramanian at Bank of America says without the Magnificent Seven, the S&P 500 Index would only be trading at 15x earnings compared to 20x right now. There is likely much opportunity for improved returns outside of this small selection of stocks.

Similarly, even if central banks are not quite done with their inflation fight yet, the higher yields resulting from the hikes we’ve already seen mean fixed income investments are potentially more attractive than they’ve been in years and future hikes are likely to have less negative impact on prices.

At the risk of sounding boring, we reiterate our comments from last quarter (good investment strategy vary rarely changes from quarter to quarter), i.e. we recommend being patient and staying diversified. This is not a time to take undue risk and chase returns, but also not a time to abandon your long-term strategy by becoming too conservative. While bonds and cash look attractive in the near term (and certainly have a role to play in portfolios, especially for those with upcoming cash needs), the tendency is to want to overweight these things during uncertain times and “wait out” the volatility. We remind investors that the best and worst days in the market tend to be clumped together, and attempting to time the market can negatively impact your long-term returns. For those with cash on the sidelines, a staggered and systematic approach to buying into equity markets is often the best approach. If you would like to review your portfolio strategy or have any other questions or concerns, please don’t hesitate to touch base. We are here to help!

Sincerely,